What is Accounting Software?

Accounting software is a digital tool that helps businesses track, manage, and organize their finances. These tools automate manual processes and help brands save time determining their financial status.

Nowadays, modern accounting apps handle the essential financial functions small businesses need, including, but not limited to, managing what customers owe you and what you owe suppliers, tracking company assets, handling tax obligations, and generating comprehensive financial reports. The software automatically records transactions, creates professional invoices, monitors cash flow, produces financial statements, and simplifies tax collection and payments.

Advanced financial accounting software for small businesses also incorporates real-time data analytics, which gives business owners instant visibility into their company's financial performance and enables them to make data-driven decisions. Additionally, some accounting tools use AI to snap photos of receipts, scan the details, and automatically record the information, eliminating the need for manual data entry.

Implementing the right accounting software helps businesses free up valuable time that would have been spent on paperwork and accounting to focus on growth. Hence, whatever accounting tool your small business may choose, its features should be an investment that pays dividends in efficiency, accuracy, and strategic financial clarity. The list below will be invaluable in helping you choose the best small business accounting software.

Top 10 Accounting Features Every Small Business Needs

Let’s break down the most important accounting features that support small business growth and help you stay organized.

Invoicing and Billing

One of the most frustrating things about running a business is keeping track of payments. Sometimes, business owners encounter customers who forget to make payments and need a reminder, or keep promising they will make a payment as soon as it is convenient. As a business owner, each follow-up with the customer can feel awkward, and it is in these situations that proper invoicing can make a huge difference.

Creating invoices is about developing a clear, professional process that encourages timely payments and keeps your business's cash flow steady. When you use accounting software with invoicing features, you can create invoices that look professional, with your logo, business name, and payment details neatly laid out. The invoicing feature should also include a payment term upfront, so expectations are set from the start. Some payment terms a good invoicing feature should have are: the date the invoice was issued, the date payment is expected, the cost of items or services purchased, and the business bank account information to make payment.

Moreover, a must-have invoicing feature to look out for in any accounting tool is the ability to send automatic reminders to customers who haven’t paid. Some accounting apps let you customize how often these reminders should be sent, making it easy for your business to follow up without doing the work. In addition, brands that offer subscription services like monthly deliveries, retainer-based consulting, or regular membership plans should look for invoicing tools that can automatically send recurring invoices. This feature saves you from manually creating and sending the same invoice weekly, monthly, or at the frequency your client is billed. Once it’s set up, the accounting software handles it for you on schedule, ensuring your customers are billed consistently and on time. It also reduces the chances of forgetting to send an invoice, which can delay payments and affect your cash flow. For subscription-based businesses, this kind of automation brings peace of mind and keeps revenue flowing smoothly.

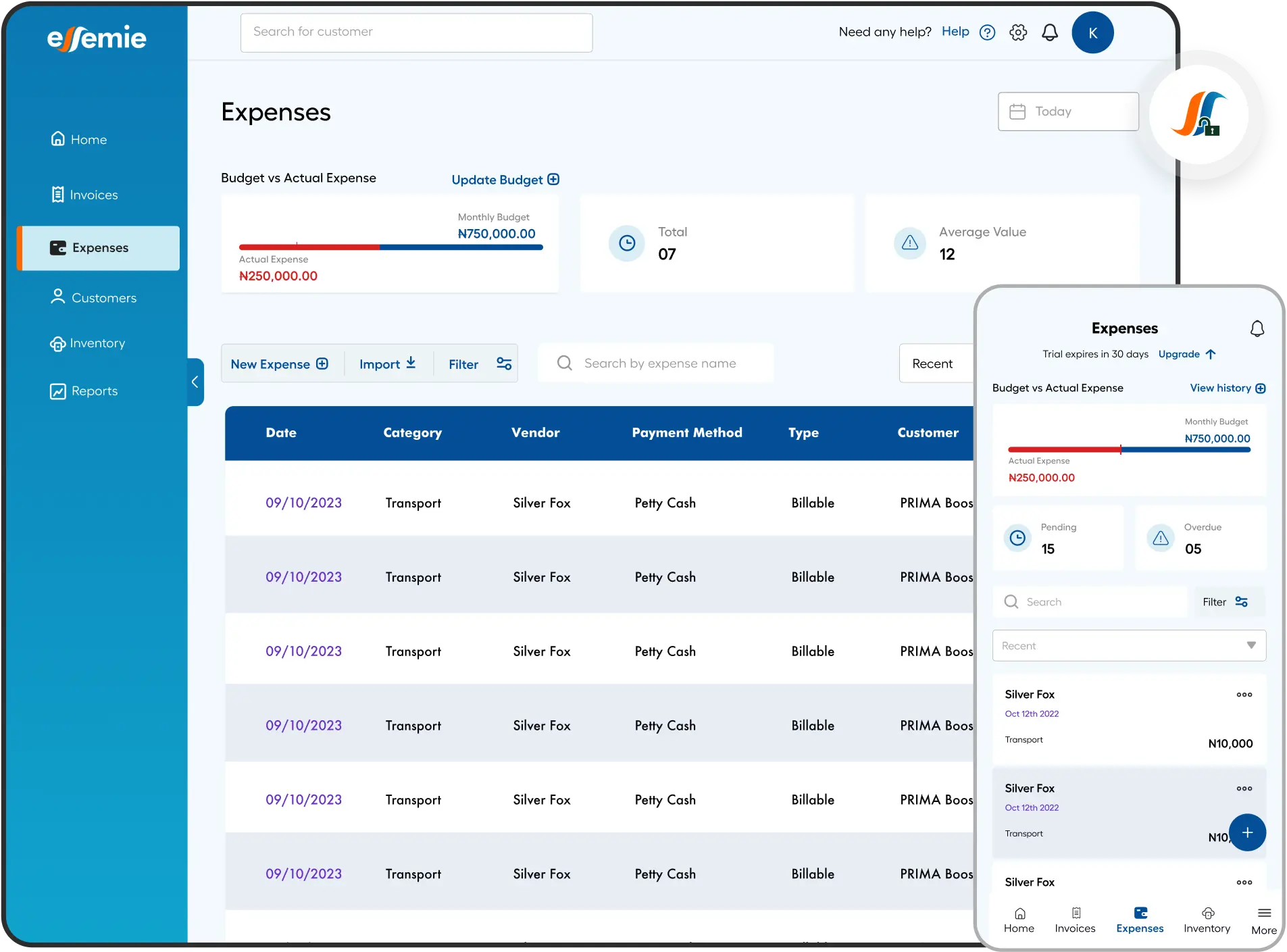

Expense and Budget Trackings

Many entrepreneurs are booked and busy, but their bank accounts at the end of the month don't reflect the hustle. This is what happens to thousands of entrepreneurs who do not use expense tracking tools, and in some cases, when personal and business funds are mixed.

The first step to taking control of your business expenses is opening a dedicated business bank account. This simple move helps you separate business finances from personal spending, making expense tracking much easier. Secondly, ensure the accounting software includes built-in budgeting tools. Budget tracking tools allow you to compare your actual spending with your financial goals for the month. It helps you see where you're overspending and where you can cut back. Over time, this supports smarter financial planning and assists you in running a leaner and more profitable business.

With a good expense tracker, you can easily record and categorize important business costs such as rent, airtime for customer service, fuel, rider payments, and staff salaries. These expense categorizations are useful in understanding which expenses cost your business the most money. Many tools even let you take photos of your receipts and upload them immediately. That means no more searching through your office drawer, bags, or the car for crumpled paper slips. Some accounting apps also match your expenses with bank transfers, which saves you the stress of sorting through transactions manually.

Once you choose the right accounting software, you'll be able to build the habit of tracking expenses and answer important questions such as:

- How much does it really cost to run my business each month?

- Where am I spending too much?

- Am I making a profit, or just staying busy?

These accounting features give you a clear picture of your business expenses and help you plan better for the future.

Bank Reconciliation

Bank reconciliation is the process of matching the transactions recorded in your small business accounting software with the ones on your bank statement. In simple terms, it helps you confirm that the money you believe you have in your business is the same as what your bank says you have. This accounting feature is important, especially in Nigeria, where many brands use multiple bank accounts to accept payments, make transfers, and process POS transactions. There’s also the challenge of dealing with occasional failed or delayed transactions, which makes reconciliation even more essential.

Small business accounting software has made things much easier. You can connect your business bank account directly to the platform, and the software will automatically import and categorize your transactions. It then matches each payment or deposit with the relevant records in your system to ensure everything is accurate. Reconciling your bank transactions helps you spot suspicious activity early. For instance, if someone withdrew money or made a payment you didn’t authorize, you’ll catch it fast. It also helps detect employee theft or fake expenses if you have staff handling finances. This aids you in avoiding issues later on, especially when filing taxes to the Federal Inland Revenue Service (FIRS), or when applying for funding.

With the right accounting software, you don’t have to sit down with your calculator and go line by line through your bank statement anymore. This process is automatic and far more accurate, helping you save time, reduce errors, and get a clearer picture of your business finances.

Tax Management and Compliance Tools

Paying tax is something many small business owners find confusing because they aren’t sure which taxes they are required to pay, and others have delayed dealing with it for so long that catching up now feels nearly impossible. But ignoring taxes doesn't make the problem go away. It usually makes things worse. Late payment penalties increase quickly, and once your business ends up on the government’s radar, you could be asked to pay far more than you would have if you had simply stayed compliant from the beginning.

The Federal Inland Revenue Service (FIRS) requires businesses to file their taxes regularly, such as Value Added Tax (VAT) returns, and Corporate Income Tax (CIT), while your state’s internal revenue board could request proof of Pay As You Earn (PAYE) deductions for your employees. Using small business accounting software helps you stay compliant by keeping your records up-to-date, calculating the right amount to pay, and helping you prepare the documents required by the FIRS. Some tools even guide you step-by-step through what to file and when. This ensures you avoid penalties, reduce errors, and stay on the right side of the law.

A good accounting apps also keep proper records of all taxes paid, which is very useful during tax audits or when you need to show proof later. Some even generate simple tax reports with which you can file your returns easily. With the right tools, tax reporting becomes less stressful, more accurate, and takes less of your time.

Financial Reporting

Financial reporting is one area you shouldn’t overlook if your small business is considering accounting software. It is a feature in most small business accounting tools that automatically generates key business reports. These reports include:

- Profit and loss statements that show you how much your business is actually making.

- Cash flow reports help businesses understand how money moves in and out.

- Balance sheets to understand your business’s assets, liabilities, and overall financial position.

- An invoice report can show you which customers still owe you money, how much they owe, and how long their invoices have been overdue.

These financial reports are key in understanding the right financial decisions that lead to overall business growth. Without them, you may be guessing when it comes to spending money, changing your prices, or growing your business. Succinctly, good financial accounting software enables you to understand the full picture of your business growth

Project Accounting

If your business works on different jobs or contracts, such as events, construction, training, or product supply, then tracking the income and expenses for each project is very important. Small business accounting software helps monitor how much you’re spending and earning on each project separately. With this, you know which projects are profitable or eating up your money.

Some accounting apps even allow you to assign invoices, expenses, and payments to specific projects. You can then generate reports like profit and loss or expense reports for each project to see the full financial picture. These powerful accounting features help you make better decisions, avoid overspending, and manage your resources wisely.

Multi-User Access and Role-Based Permissions

As your business grows, you might not be handling everything on your own anymore, and that includes your finances. Maybe your staff, accountant, or business partner also needs access to your financial records. In situations like this, your accounting software needs to support teamwork without compromising security.

Multi-user access allows more than one person to use your accounting software at the same time. Instead of sharing your own login details, you can create individual accounts for each person who needs access. This keeps your login secure and also allows you to see who is doing what within the system.

Role-based permissions let you decide what each user is allowed to see and do while you remain fully in control of your financial data, even if multiple people are working in the system. For example, let’s say you own a fashion retail business in Lagos. Your store manager can record sales and track customer payments, but cannot view confidential reports like your profit and loss statement.

While a junior staff member in charge of stock can input inventory expenses, but cannot approve payments or modify past entries. As the business owner, you can access all the financial reports, prepare tax documents, and reconcile bank accounts.This level of access control protects your sensitive business information from accidental changes, misuse, or even internal fraud. It also allows your team to focus on their specific tasks without getting overwhelmed by features they don’t need.

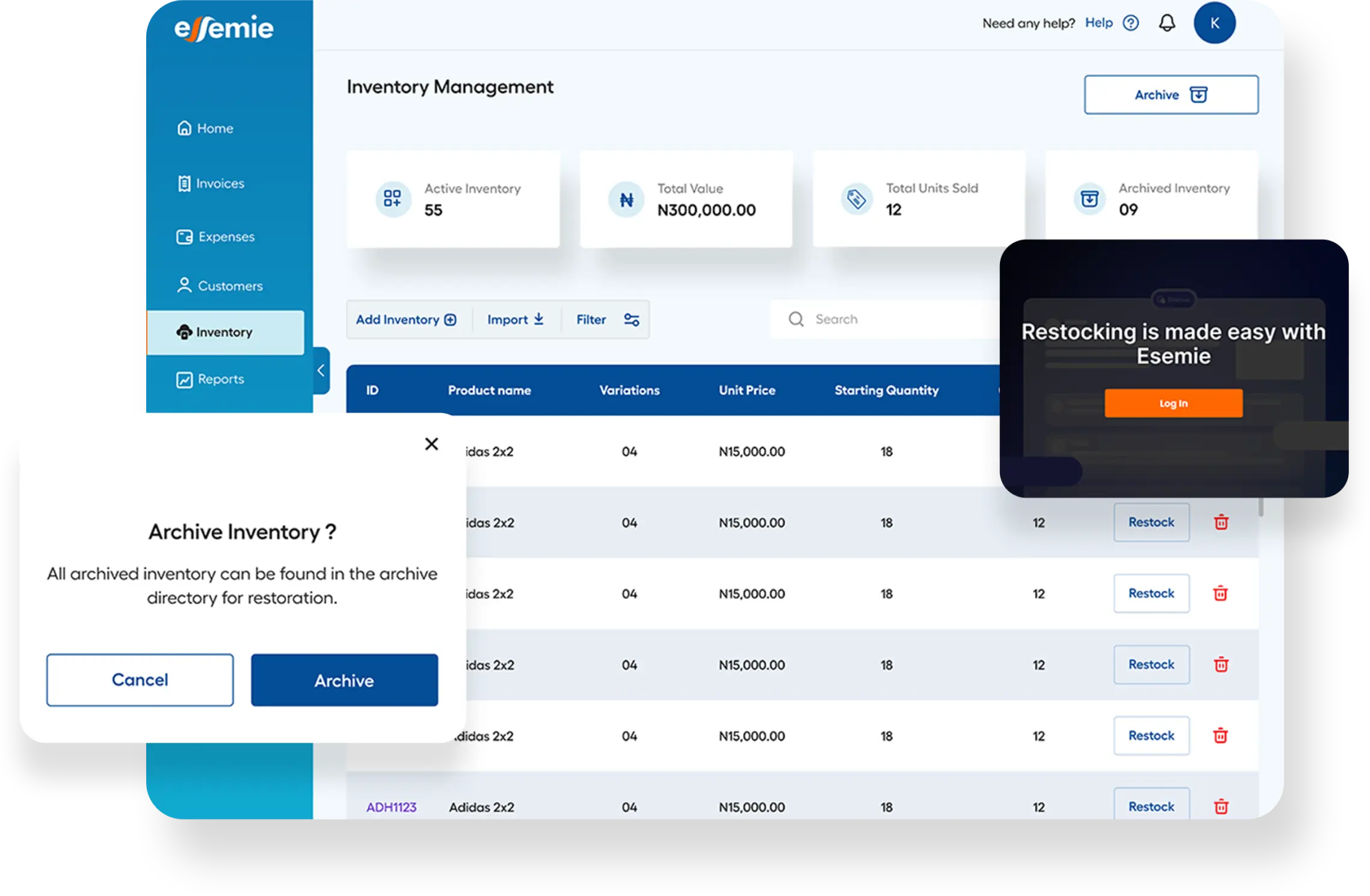

Inventory Management

For businesses that sell physical products like clothes, cleaning supplies, electronics, or food, inventory management is very important. It’s the link between your sales and your finances. Keeping track of what you have in stock, what’s selling fast, and what’s not moving at all can make or break your profit margins.

Gone are the days of manually counting stock or updating Excel sheets that quickly go out of date. Small business accounting software often includes inventory management tools that help you stay updated about your products in real-time. This means you can automatically track your stock levels, set low-stock alerts, and even know the exact cost of each item sold, all without stress.

A good financial accounting software with built-in inventory tools helps you manage your products easily. You can add new items, set prices, write descriptions, and organize them into categories like size, color, or type. Some accounting tools also help you calculate the cost of goods sold (COGS), which directly affects your profit and pricing decisions.

More advanced accounting apps also connect your sales to your inventory automatically. That means when you sell a product, your stock level updates instantly, so you don’t accidentally sell what you don’t have. You can also see which items are selling fast, which ones are slow, and get alerts when stock is running low. This helps you restock on time, avoid losses, and manage your money better. For brands setting up an accounting system for their small business, inventory features are a must-have for staying in control and planning.

Asset Tracking

If your business owns valuable equipment, tools, vehicles, or devices, then asset tracking is an accounting feature you shouldn’t overlook. It helps you monitor what your business owns, where those items are, how they’re being used, and what they’re worth over time. In simple terms, asset tracking allows you to keep a clear and updated record of all the fixed assets in your business. These may include things like laptops, printers, delivery bikes, machinery, generators, or office furniture. Instead of relying on memory or scattered records to track when you purchased these items or how much they cost, everything is documented and organized within one accounting software.

Over time, the accounting software can show you how much each asset has depreciated, which is important for accurate financial reporting. This type of tracking also helps prevent loss or theft, especially when multiple team members use shared equipment. If assets are assigned to specific individuals, it becomes easier to keep everyone accountable. As a business owner, you can also plan better by knowing when an item is nearing the end of its useful life or starting to require frequent repairs. This helps with budgeting for replacements rather than being caught off guard.

From a tax standpoint, asset tracking supports proper documentation when reporting to the Federal Inland Revenue Service. If your business qualifies to claim capital allowances, having clear records of asset values and depreciation makes the process much smoother and more accurate. Without asset tracking, it’s easy to lose sight of what the business owns, forget the true value of long-term equipment, or make errors during tax filings.

Cloud-Based Access and Data Backup

Having access to your financial information anytime, anywhere, is crucial. When your accounting tool is cloud-based, it means your data is stored securely online instead of on just one computer. You can log in from your phone, tablet, or laptop irrespective of your location. This kind of flexibility gives you access to your small business accounting software, whether you're in the office, at home, or even on the road.

More importantly, cloud-based systems automatically back up your data. So, in the case of an unfortunate event where your computer crashes or your phone gets stolen, your financial records are safe and still accessible. You won’t have to start from scratch or lose important information about your sales, expenses, or customer payments. The best financial accounting software keeps your data secure and protected in the cloud. This means your information is always safe, up to date, and easy to recover. Some small business accounting tools like Esemie are not only cloud-based, but they also guarantee access to the software via mobile phones, tablets, and even desktop or laptop computers.

How to Choose the Right Accounting Software

The best accounting software is the one that meets your specific needs, fits your level of financial knowledge, and grows with your business over time. Start by thinking about the core features your business actually needs. For example, if you run a retail store or an online shop, inventory management and invoicing may be top priorities. If you offer professional services, you may need software that handles recurring billing, expense tracking, and payroll. Every business is different, so avoid going for flashy features you’ll never use. Instead, focus on what will save you time and help you stay organized.

Ease of use is also important. As a small business owner, you may not have an in-house accountant. That means your accounting software should be easy to navigate, even if you don’t have a finance background. Tools like Esemie are built with this in mind, giving you an easy-to-use platform that simplifies everyday accounting tasks without overwhelming you

Finally, look at the cost. While free tools can be tempting, they often come with limitations that slow you down as your business grows. It’s better to choose software with a clear pricing plan and the right mix of features for your current stage. Think of it as an investment in better decision-making and long-term growth. Additionally, take the time to assess your needs, test a few options, and pick the one that gives you confidence every time you log in. If you’re looking for something simple, reliable, and tailored for your small business growth, Esemie is a great place to start.