What are Financial KPIs?

Financial KPIs are key numbers that show how your business is doing with money. They help you know if you're making a profit, spending too much, or growing the way you should.

Think of these financial performance indicators like a health check for your business. Just like you check your blood pressure or sugar level to know how your body is doing, financial KPIs help you check your business’s financial health.

Some common financial KPI examples include revenue, net profit, gross margin, cash flow, and expenses. These business metrics help you make better decisions, like when to increase your prices, reduce your spending, or invest in something new.

If you have financial goals, whether it's to expand, restock, or apply for a loan, you’ll need these numbers to clearly show how your business is performing. And to make tracking easier, you can use business accounting software or financial management software. These tools make expense tracking, budgeting, and reporting much simpler.

A good financial statement software for small businesses can save you time and stress by keeping all your important business KPIs in one place, so you’re not doing everything manually.

Defining and Choosing the Right Financial KPIs for Your Small Business

Not all financial KPIs are important for every business. To choose the right ones for your small business, you need to first think about your business goals. What are you trying to achieve? Is it to increase your profit, reduce expenses, get more customers, or manage your stock better?

Once you’re clear on your goals, pick financial performance indicators that match those goals and help you take action, not just numbers that “look good” but don’t actually help you grow. These are sometimes called vanity metrics and should be avoided.

The best financial KPIs are SMART. That means they are:

- Specific: Clear and focused on one part of your business

- Measurable: Can be tracked with numbers

- Achievable: Realistic based on the kind of business you run

- Relevant: Realistic based on the kind of business you run

- Time-bound: Can be measured within a set period (weekly, monthly, quarterly)

For example, if your goal is to manage how much you’re spending, focus on expense tracking and budget performance indicators. If you run a product-based business, you may want to track stock levels and gross profit margin. For a service-based business, you might focus on income per job and cash flow.

You don’t need to track too many KPIs at once. Start with 3 to 5 financial management KPIs that are most important to your business, since you can always add more as your business grows.

By choosing the right business metrics and using reliable financial software, you’ll be able to make better financial decisions and focus on what truly helps your business grow.

Top Financial KPIs Nigerian Business Owners Should Track

To know if your business is doing well financially, there are some key financial KPIs you should be tracking regularly. These numbers help you understand how much you're making, how much you're spending, and where you need to adjust to grow and stay profitable.

Here are some of the top financial performance indicators every Nigerian business owner should keep an eye on:

Net Profit

Net profit is the money your business has left after removing all your costs and taxes from your total sales. In simple terms, it’s what’s left after you’ve paid for everything (like rent, salaries, transport, raw materials, electricity, tax, etc.).

This is one of the most important financial KPIs for any business. If your net profit is low or negative, it means you’re spending more than you’re earning, and that can be risky. You could run into debt or even shut down if this continues.

It’s also called the “bottom line” because it usually appears at the bottom of your profit and loss report.

Net Profit = Revenue – Total ExpensesFor example, if you made ₦1,000,000 in sales and your total expenses were ₦700,000, your net profit would be ₦300,000. That means your business is doing well.

Tracking your net profit regularly helps you know if your business is truly profitable or just making sales without real gain.

Gross Profit Margin

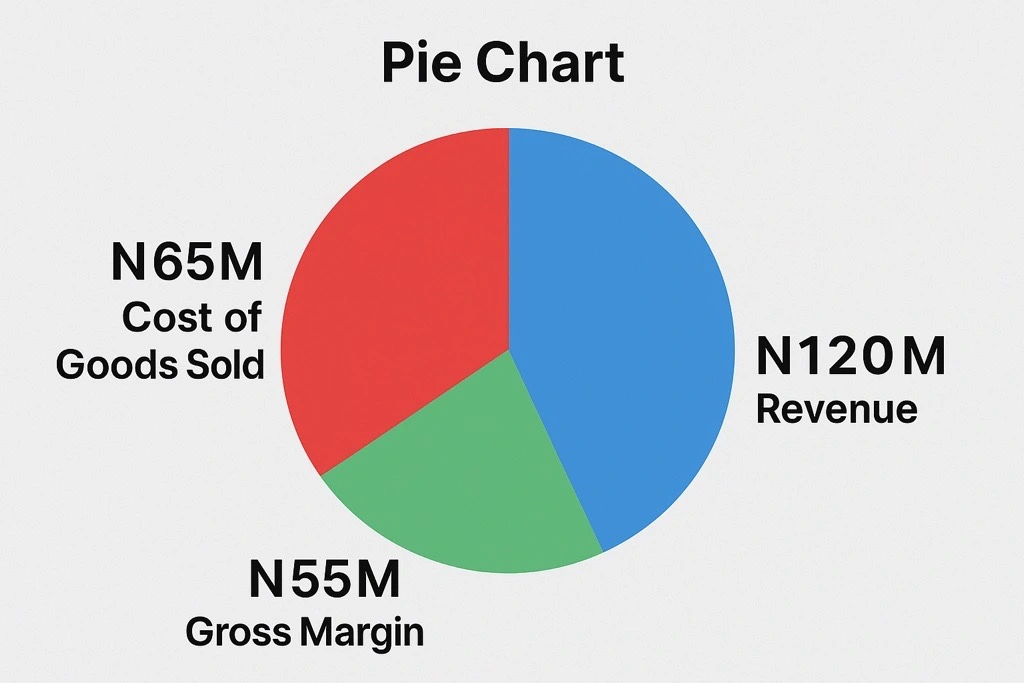

Gross profit margin shows how much money your business keeps after removing the direct cost of producing or selling your product. These direct costs are called Cost of Goods Sold (COGS), and they include things like raw materials, packaging, and labor used to make or deliver your product.

Put simply, gross profit margin tells you how much you’re earning from your sales before you pay for things like rent, salaries, fuel, or electricity

It’s usually written as a percentage. For example, if your gross profit margin is 60%, it means that for every ₦1,000,000 in sales, you keep ₦600,000 as profit after removing the cost of producing the goods, while ₦400,000 goes into making those goods.

Gross Profit Margin = (Revenue – Cost of Goods Sold) ÷ Revenue × 100Let's say you made ₦500,000 in sales and the cost of producing the goods was ₦200,000, then your gross profit is 60%

This financial KPI helps you check if your pricing is okay or if you’re spending too much on production. If your gross profit margin is low, you might need to reduce your production cost or increase your selling price.

Cash Flow

Cash flow is the money that moves in and out of your business over a period of time. It shows whether you have enough money to run your business and pay your bills

If more money is coming in than going out, that’s a positive cash flow, and it’s a good sign that your business is doing fine. But if you have negative cash flow, it means you’re spending more than you’re earning, and this can lead to problems like late payment, running into debt, or shutting down your business.

Tracking your cash flow helps you answer key questions like:

- Can I pay my staff and suppliers this month?

- Can I restock my goods or pay rent?

- Do I need to reduce my spending?

Regularly checking your cash flow helps you see when to cut spending, follow up on customer payments, or slow down on buying new stock.

Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue (MRR) is the money your business earns every month from customers who pay you regularly, like weekly or monthly. This works well if you offer a subscription, membership, or payment plan for your product or service.

For example, if you run a cleaning product refill service and 10 customers pay ₦5,000 every month, your MRR is ₦50,000. Even if you don’t make any new sales that month, you already know you’ll get ₦50,000 from those 10 customers.

MRR = Total number of active paying customers × Average monthly payment.Tracking MRR helps you know how much steady income is coming in every month, plan better for your expenses, predict how fast you’re growing, and know if your business is stable or losing customers.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is how much it costs you to get a new customer. It includes everything you spend on marketing, advertising, sales, or even staff salaries and tools used to bring in new customers.

For example, if you spend ₦100,000 on marketing in a month and you get 20 new customers from that effort, your CAC is ₦5,000. That means you’re spending ₦5,000 to get each new customer.

CAC = (Cost of Sales + Cost of Marketing) ÷ Number of New CustomersKnowing your CAC helps you see if you’re spending too much to get customers. If your product sells for ₦3,000 but you’re spending ₦5,000 to get a new customer, this means you're running at a loss.

To make your business more profitable, you can reduce CAC by focusing on cheaper marketing channels, targeting the right audience, keeping your current customers happy, and encouraging repeat purchases.

Inventory Turnover

Inventory turnover shows how often you sell and restock your goods within a period, usually in a month or a year. It helps you see how fast your products are moving. If your inventory turnover is high, it means you're selling your goods quickly. If it’s low, your goods are staying too long on the shelf.

For example, if you sell clothes and you restock every month, your turnover is good. But if the same clothes stay on the shelf for 3 - 4 months without selling, it may be a sign of slow sales, too much stock, or that people don’t really want that product.

Inventory Turnover = Cost of Goods Sold ÷ Average InventoryLet’s say your cost of goods sold in a year is ₦1,200,000, and your average inventory is ₦300,000, then your inventory turnover is 4. This means you sold and restocked your goods 4 times in one year.

Accounts Receivable Days

Accounts Receivable Days shows how long it takes your customers to pay you after making a purchase on credit. It helps you know if people are paying you on time or if you're waiting too long to get your money.

Let’s say you run a fashion store and allow some customers to buy now and pay later. If many of them delay payment, your business might suffer, even if you're making sales, because the money isn't coming in when you need it.

To manage this, keep track of who owes you and for how long, follow up quickly on overdue payments, offer small discounts to customers who pay early, and think twice before selling on credit to customers who always pay late.

The faster you collect your money, the better your cash flow, and the easier it is to keep your business running smoothly.

Accounts Payable Days

Accounts Payable Days shows how long it takes you to pay your suppliers or service providers after receiving goods or services. It helps you know if you’re paying your bills on time or taking too long.

For example, if you buy raw materials or stock from a supplier and they give you 30 days to pay, it’s important to pay within that time. Delaying payments can affect your relationship with suppliers, damage your business reputation, or even make it harder to buy on credit next time.

Paying your bills on time shows that your business is reliable and can help you get better deals or discounts. Some suppliers even offer small price reductions if you pay earlier than the due date.

By tracking your Accounts Payable Days, you can plan your expenses better, avoid supply delays, and maintain good relationships with the people you do business with.

Revenue

Revenue is the total money you make from selling your products or services, before you remove any costs or expenses. It’s also called “sales” or “top-line income.”

For example, if you sell 100 packs of chin chin for ₦500 each, your revenue is ₦50,000 (₦500 × 100). This doesn’t mean it’s your profit; it’s just the total money that came in from sales.

Revenue = Selling Price × Number of Units SoldThere are two common ways businesses track revenue. Some record sales as soon as a customer buys (even if the money hasn’t entered the account yet), while others only count sales after they receive the payment.

Keeping track of your revenue helps you see how your business is growing, how much you're really selling, and whether you're meeting your sales goals.

Expenses

Expenses are the total costs your business spends to operate and make sales. They include things like rent, staff salaries, materials, transport, internet, electricity, and other daily costs.

For example, if you run a food business, your expenses may include ingredients, gas, packaging, delivery, and payment for your workers. These are the things you must spend money on to keep your business running.

There are two main types of expenses:

- Operating expenses: These are the everyday costs of running your business, like rent, production materials, transport, marketing, and salaries.

- Non-operating expenses: These are other costs that are not part of your daily operations, like loan interest, bank charges, or one-time fines.

There are also two ways to track your expenses. With accrual accounting, you record the expense when you receive the goods or service, even if you haven’t paid yet. With cash accounting, you only record it when you actually pay the money.

Expenses = Cost of Goods Sold + Salaries + Sales Commissions + Marketing Costs + Rent + UtilitiesKeeping good records of your expenses helps you know where your money is going, control your spending, and plan better. If your expenses are more than your revenue, your business will struggle to grow or make a profit.

Budget vs Actual Expenses

Budget vs Actual Expenses helps you check if your business is spending or earning as planned. It simply compares what you expected to spend or earn (your budget) with what you actually spent or earned.

For example, let’s say you planned to spend ₦100,000 on buying stock this month, but you ended up spending ₦120,000. That means you overspent by ₦20,000. On the other hand, if you expected to make ₦200,000 in sales but made ₦250,000, then your sales performed better than planned.

This kind of check is called budget variance analysis. It helps you see where you’re spending too much, find areas where your business is doing better than expected, and adjust your plans or spending style for the next month.

Budget Variance (%) = (Actual – Budget) / Budget × 100Regularly checking your budget vs actual helps you stay on track, manage your money wisely, and make better business decisions going forward.

Churn Rate

Churn Rate shows how many customers stop buying from you or using your service over a period of time. It helps you see if people are staying with your business or if they’re leaving too quickly.

For example, if you run a laundry service and you had 100 regular customers at the start of the month but only 80 remain by the end, it means 20 customers left, that’s a churn rate of 20%.

Churn Rate (%) = (Customers Lost ÷ Starting Number of Customers) × 100A high churn rate is not a good sign for your business. It could mean something is wrong, maybe your service quality has dropped, your prices are too high, or your customers don’t feel valued. If too many customers stop coming back, you’ll spend more money trying to get new ones instead of keeping the ones you already have.

Tracking your churn rate helps you know whether to improve your product or service, check in with old customers, or offer better support to keep people coming back.

Cash Runway/Burn Rate

Cash Runway shows how long your business can keep running before it runs out of money, based on how much cash you currently have and how much you spend every month.

For example, if you have ₦500,000 in your account and your business expenses are ₦100,000 every month, your cash runway is 5 months. This means if no more money comes in, your business will run out of cash in 5 months.

Cash Runway = Cash Balance ÷ Monthly Burn RateYour burn rate is the amount of money your business spends every month. This includes things like rent, salaries, stock, and other regular expenses.

These two numbers help you plan better. If your runway is getting shorter, it means you’re spending too much or not earning enough. You may need to reduce your spending or look for extra funding to keep your business going.

How Can Financial Software Help With Setting and Tracking Your Business Financial KPIs

As your business grows, it becomes harder to track all your income and expenses using notebooks or spreadsheets. You may forget to update your records or make small errors that can lead to big mistakes. Even checking simple numbers like revenue or profit can start to feel confusing and stressful.

Now imagine trying to calculate more advanced business KPIs like how many customers stop using your service (churn rate) or how much it costs you to get a new one (CAC). Doing all that manually will take time, and you might still get the numbers wrong.

With financial management software or business accounting software like Esemie, you can easily track and calculate important numbers with just a few clicks. Instead of spending hours doing the math's, this software does the work for you. You’ll also be able to generate reports automatically, showing how your business is performing weekly, monthly, or whenever you need them.

Good financial software makes it easier to set and monitor the right financial KPIs for your business. It saves you time, gives you accurate numbers you can trust, alerts you when something goes wrong, and helps you make better business decisions based on real numbers..

For example, instead of guessing how much you spent last month, Esemie handles expense tracking automatically. Or you’re struggling to compare your budget with what you actually spent, the system shows you clear budget performance indicators. You can also track your growth, so you know how close you are to hitting your goals.